2018q1

Regional eXplorer (ReX) Update, 1st Quarter of 2018

Welcome to the first update for 2018. Regional eXplorer is a consolidated platform of integrated databases that provide accurate and up-to-date statistics down to the local municipal level for South Africa. As an industry leader, our clients use our data in a variety of ways to inform their decision making and require ReX to be constantly updated with the latest data. We strive to provide these data updates in a consolidated manner on a quarterly basis.

Main data releases incorporated in this update

2017 data is now available: ReX has been updated with the latest data available from StatsSA, SARB, SARS and many other data sources that allowed us to model and estimate the 2017 data for the majority of the modules in ReX, including:

- Demographics

- Development

- Labour

- Income & Expenditure

- Economic

- Tourism

- International Trade

Topics that are heavily dependent on information from the General Household Survey (for example the Household Infrastructure module) will only be available later in the year after StatsSA has released the GHS 2017 data.

Regional Perspectives: Global Outlook

Global risks are rising at the same time the economic outlook has brightened.

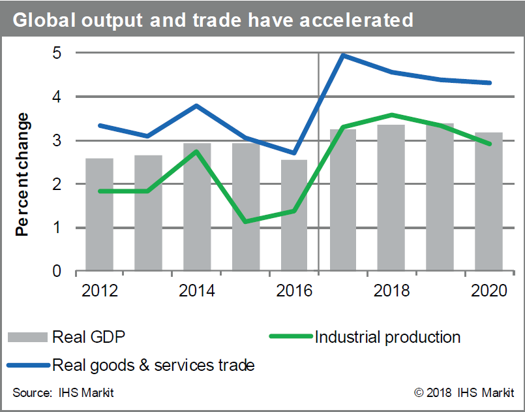

A year ago, IHS Markit said the outlook was brighter and the risks higher than in early 2016. The good news is the outlook is brighter still than in early 2017. The bad news is the risks are also higher. After a 3.2% expansion in 2017, global real GDP is projected to increase 3.4% in 2018 and 2019, followed by 3.2% growth in 2020. Compared with last month, we have revised up our forecasts of 2019 and 2020 growth rates 0.1 percentage point, reflecting stronger growth in the global economy, induced by more fiscal stimulus. From 2017 to 2020, the world economy is likely to enjoy the strongest back-to-back growth rates since the mid-2000s. Nevertheless, the risks to the expansion have also risen dramatically in recent months.

Developed world business optimism, meanwhile, kicked higher in February, to the highest level since March 2015. Other subindexes from the global PMI added to the upbeat picture and suggest the upturn has farther to run. Worldwide employment growth continued to register its highest reading in a decade, buoyed by firms adding capacity, which has been increasingly stretched because of faster growth of new orders. February also saw inflows of new business rise at the fastest pace since June 2014.

Regional Perspectives: South African Near-term Outlook

Positive political sentiment continues to support the South African rand exchange rate, which strengthened by 12% against the US dollar during the first two months of 2018.

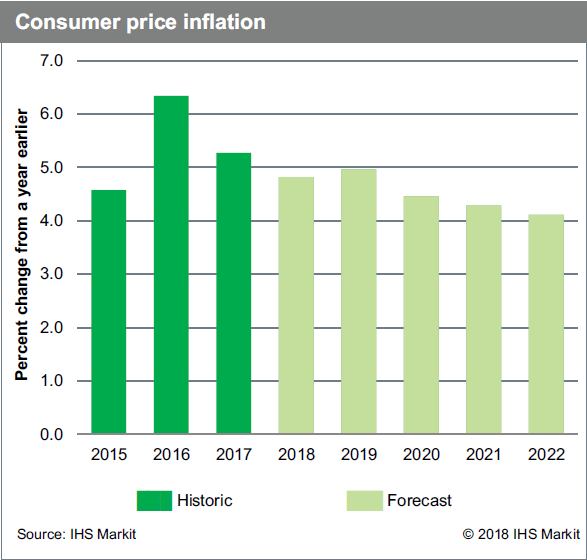

The favourable exchange rate trajectory is expected to mitigate the inflation impact of the 1% increase in the South African value-added tax (VAT) rate to 15%, announced in the 2018/19 national budget.

With headline inflation expected to remain within the inflation target range of 3–6%, a 50-basis-point cut in the South African Reserve Bank’s policy rate is assumed for 2018. A favourable global economic backdrop further supports the expected cyclical upturn in the South African economy during 2018. IHS Markit is of the view that GDP growth could average 1.6% in 2018 and 2.0% in 2019.

The South African economy is moving from one milepost to the next, with crucial political and fiscal outcomes supporting a mild GDP growth recovery and a stronger rand exchange rate during 2018. The election of Cyril Ramaphosa as the new leader of the African National Congress (ANC) in December 2017 was soon followed by the resignation of Jacob Zuma as the president of South Africa on 14 February 2018. Cyril Ramaphosa was sworn in as the president of South Africa on 15 February, which boosted not only domestic, but also international investor sentiment. This was followed by the release of the 2018/19 national budget, presented by the incumbent finance minister at the time, Malusi Gigaba, on 23 February, outlining a fiscal program that allows public-sector debt consolidation below the 60%-of-GDP threshold over the medium term. A cabinet reshuffle that occurred on 26 February aims to root out state mismanagement and corruption.

The rand exchange rate appreciated to ZAR11.55/USD1.00 by end-February, its best level in more than four years. The favourable exchange rate trajectory is expected to mitigate the inflation impact of the 1% increase in the South African value-added tax (VAT) rate to 15% from 14% previously, announced in the 2018/19 national budget. Moreover, IHS Markit is of the view that South Africa’s headline inflation rate will remain within the South African Reserve Bank’s (SARB) target range of 3–6% during 2018–19, enabling a 50-basis-point cut in the policy rate during 2018. Low inflation, combined with lower interest rates, is expected to sustain real household income growth and consumer spending during 2018. Higher taxes and structural impediments, such as a high unemployment rate and a high level of household leveraging, will continue to curtail consumer growth.

Fixed investment spending is unlikely to show any significant rebound during 2018–19. Although business and consumer sentiment received a considerable boost following the recent political developments, a hike in effective tax rates for businesses and consumers is expected to curtail residential and non-residential investment during 2018. A significant decline in public-sector investment funding in the 2018/19 budget underscores this expectation.

Regional Economic Data Forum (REDF): Fee-Free Tertiary Education

During February, IHS Markit held the first REDF for 2018 in Nelspruit, Mpumalanga.

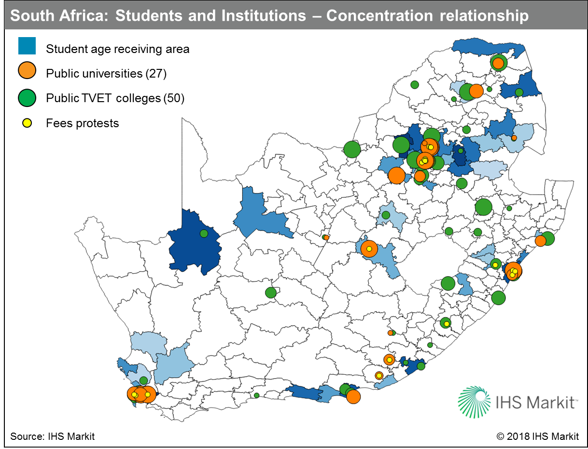

One of the presentations at the event was an analysis on Free Tertiary Education in South Africa. In line with the sentiments of #feesmustfall protesters who since 2015 sparked a nationwide revolt against high university fees as a barrier for deserving poor students, former president, Jacob Zuma, announced fee-free education on 16 December 2017. The 2018 budget presented how the government plans to fund free tertiary education. As expected, this comes with significant cuts and re-allocations of government expenditure.

The presentation also highlighted the differences between Universities and TVET colleges. Universities are highly concentrated within urban areas compared to more wide-spread TVET colleges. From a costing perspective, it costs five times more to fund a student from a University when compared to a TVET college student.

Please join us at our next Regional Economic Data Forum in Cape Town.

- Date: Wednesday, 18 April 2018

- Time: 10:00 a.m. – 1:00 p.m. (Registration 9:30 a.m.)

- Venue: Townhouse Hotel, 60 Corporation Street, Cape Town

- Cost: Free, but there are limited seats available.

Book your seat a.s.a.p. by either contacting Johan Boshoff at johan.boshoff@ihsmarkit.com or phoning 012 622 9660.