2019q3

Regional eXplorer (ReX) update – 3rd quarter of 2019

IHS Markit is glad to announce the third quarter update of Regional eXplorer (ReX) – the South African knowledge base of municipal level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

SOUTH AFRICAN MACROECONOMIC OUTLOOK

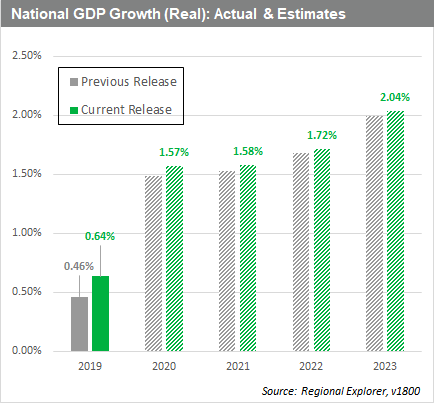

Weak growth during the first quarter of 2019 pushes the IHS Markit growth expectation down to 0.6% for 2019

IHS Markit has lowered South Africa’s overall GDP growth expectation for 2019 from 1.2% made earlier this quarter to 0.64%, following electricity disruptions combined with a stretched-out gold mining strike contributed to the dismal growth numbers. IHS Markit is of the view that limited upward momentum exists to propel the economy on a higher growth path for the remainder of the year.

Preliminary estimates point to limited upward growth momentum during the second quarter. The Standard Bank Purchasing Managers’ Index (PMI) for the whole economy, compiled by IHS Markit, remained below the 50.0 neutral threshold for most of the second quarter. The PMI posted a reading of 49.7 in June, a slight rise from 49.3 in May. “Altogether, this pointed to a mild deterioration in operating conditions at South African companies, marking the first back-to-back monthly decline since January,” the PMI reported. Pressure on durable consumer demand mirrored sluggish domestic vehicle sales. The National Association of Automobile Manufacturers of South Africa (NAAMSA) reported a 3.2% year-on-year (y/y) contraction in domestic passenger vehicle sales during June. Real retail trade sales trended up marginally and averaged 2.5% y/y for April–June 2019.

Consumer spending, accounting for more than 60% of real GDP, is unlikely to show a strong recovery during 2019. A rising tax burden, moderate salary increases in the private sector, and rising unemployment are projected to overshadow a slight reprieve on real disposable income levels despite the 25-basis-point reduction in the SARB’s policy rate during July. The FNB/BER consumer confidence indicator gained marginally during the second quarter of 2019 but remains well below readings recorded at the beginning of 2018, reflecting weak consumer sentiment.

Any possible rebound in fixed investment spending will remain constrained by high levels of global and domestic uncertainty. The global outlook is overshadowed by the upcoming Brexit deadline in October and escalating trade tension between the United States and its trading partners. Sporadic political flare-ups due to the discrepancy in the ruling African National Congress (ANC) party’s future policy direction, uncertainty over sustainable electricity provision and tariffs, lack of clear direction over future property rights, increased crime and corruption, and weak growth will, in the opinion of IHS Markit, continue to deter fixed investment spending in the South African economy. A rising public-sector interest rate burden and financial support to state-owned entities (SOEs) continue to crowd out capital spending in the public sector.

South Africa has not yet benefited from an export-related manufacturing or mining sector boom as a step back in business policy reforms; high unit labor cost, sporadic electricity disruptions, and disruptive strike actions continue to impede the country’s international competitiveness. A weaker rand exchange rate could nonetheless mitigate the effect of some of these factors and increase overall export earnings during the year.

IHS Markit expects the SARB’s policy rate to remain unchanged until end-2019.

With South Africa’s medium-term inflation projections now solidly within the 3–6% inflation target range, the SARB

has cut its policy rate by 25 basis points during July. Weak demand-push factors combined with a slowdown in inflation expectations in the South African economy underscore the inflation projections. Cost-push factors such as rising fuel prices and electricity cost combined with a vulnerable rand exchange rate continue to pose a risk to the medium-term inflation projections, with no further interest rate cuts assumed for the remainder of 2019.

Escalating trade tensions between the United States and China have left the rand exchange rate close to 7% weaker against the greenback during the first half of August. The riskier global environment, which bodes less positive for commodity-dependent exporters such as South Africa, triggered an acceleration in the sell-off of local currency–denominated debt by foreign investors as dollar returns fell significantly during the month. However, the risk-off sentiment towards South African debt holdings was exacerbated by local economic and political developments. Rising fiscal and public debt concerns, with no clear direction in addressing financial constraints at SOEs such as Eskom, have increased the possibility of South Africa falling out of the World Government Bond Index (WGBI) due to the sovereign’s loss of its last local currency debt investment rating by Moody’s. This bodes particularly ill for volatile portfolio inflows, which account for the largest financier of South Africa’s current-account deficit, ensure stable foreign exchange holdings, and are a primary financier of external liquidity needs in the economy. Overall, IHS Markit finds it unlikely the rand will trail below the ZAR15.00/USD1.00 level during the fourth quarter of 2019, while currency vulnerability will remain high.

In the medium term, price differentials with the rest of the world, movements in commodity prices, the current account deficit, and the level of international reserves will determine the rand’s level. South Africa has a high import propensity, which, along with slow-developing and relatively fragile export markets, should keep external accounts in the red and place downward pressure on the rand. Furthermore, inflation is expected to stay at about 5.0–5.5%, with global inflation around 2.0–2.5%. This leaves the inflation differential at approximately 3.0%, which is also the expected rate of depreciation for the South African rand in the longer term. Upside pressures on the rand, which are expected to cushion the currency’s longer-term depreciating bias, include a relatively sustained upswing in foreign investor interest toward emerging markets and upwardly trending commodity prices as global growth gradually improves.

South Africa’s fiscal backdrop has become more precarious. During August, the South African Treasury announced an additional ZAR26 billion in financial support to the struggling state-owned power producer Eskom for fiscal year 2019/20, followed by an additional ZAR33 billion in 2020/21. No clear path of debt consolidation, restructuring of business operation, or any possible downsizing of the bloated workforce was announced. With real GDP growth now expected to end 2019 at around 0.4–0.6%, well below the government’s original estimates of 1.5%, the possibility of the budget deficit widening to an estimated 5.7% of GDP, from the current budget estimate of 4.5% of GDP, has increased significantly. The IHS Markit estimates suggest the public-sector debt burden could rise to 60% of GDP by 2021/22 under the current fiscal path. The public-sector interest rate obligation has now become the fastest-growing spending component in the national budget.

Upside potential is dependent on a potential investment rebound.

An aggressive drive by new ruling president Cyril Ramaphosa to secure USD100-billion local and foreign investment in the next five years could be the swing factor in near-term growth prospects. Strong private-sector investor spending could leave South Africa’s growth rate closer to 3.5% in the near term.

Important binding constraints, including a high dependency on investment-related imports, higher inflation, inadequate infrastructure, and disruptive domestic political and labor market developments, will nonetheless continue to prevail within the assumed higher private-sector investment scenario.

MODEL REVISION: DEMOGRAPHIC MODEL

In the latest release, IHS Markit updated the Demographic module by incorporating the main demographic releases from StatsSA: births, cause of death, migration and the mid-year estimates. Along with these data sources, the ReX Demographic methodology has also been under review. We would like to provide a short refresher in the current methodology as well as highlight some of the improvements made.

The national and provincial population estimates are still obtained using a Cohort-Component Population Projection. These projections are determined by five fundamental population variables:

- Size of population in the base or starting year

- Number of deaths occurring between the base and projected years

- Number of births occurring between the base and projected years

- Immigrants arriving in the country between the base and projected years

- Emigrants leaving the country between the base and projected years

In addition to these inputs, the model also requires a lot of assumptions on finer demographic aspects such as the incidence rate of the HIV disease, how the disease spread over the years, how it impacted on orphans and babies contracting HIV, etc. Today we also have a long list of HIV intervention programs which has a significant positive impact on the life expectancies of those living with HIV.

The final population figures are based on a set of cohort-component models, with a separate balancing equation for each population group and province. We sum the individual results to arrive at the total national population. This is done because fertility, mortality and migration factors vary largely between the different population groups and provinces. This methodology ensures an accurate representation of the grouping breakdowns within and across the country. IHS Markit uses an external demographic programs called Spectrum to run the population projections, to stay up to date with the latest developments specifically that of how to treat the HIV population. The most significant changes to the current Demographic model lie within this component where the assumptions that feed into the spectrum modelling process was updated.

The Demographic module is one of the most important and highly linked modules within the ReX database and the changes seen this quarter has ‘n ripple-effect right through the model on all variables that depend on population estimates.

MAIN DATA RELEASES INCORPORATED IN THIS UPDATE

Along with the latest data available from StatsSA (incl. QLFS and GDP), ReX has also been updated with several releases from the SARB, SARS and many other data sources. The recently released Crime Statistics of South Africa have also been incorporated into this ReX update:

Compared to last year, there has been a slight increase of 0.4% in the composite weighted overall crime index, this was largely driven by the heavily weighted Violent Crime Index which increased by 1.2%.

A decline in the Trio Crime of 1.4% is welcomed for a second year in a row. The trio crime index measures the perceived level of aggravated robbery which include carjacking and robberies at residential and non-residential premises. These robberies are perceived by households as the most common and feared crimes in South Africa (2014/2015 Victims of Crime Survey, Statistics South Africa).

Enjoy the update!

The IHS Markit ReX team