2022q3

Regional eXplorer (ReX) update – 3rd quarter of 2022

IHS Markit is glad to announce the third quarter update for 2022 of Regional eXplorer (ReX) – the South African knowledge base of municipal level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

- South Africa’s real GDP should increase by 1.9% in 2022.

- South African Macroeconomic outlook

- Main data release incorporated in this update

South Africa’s real GDP should increase by 1.9% in 2022.

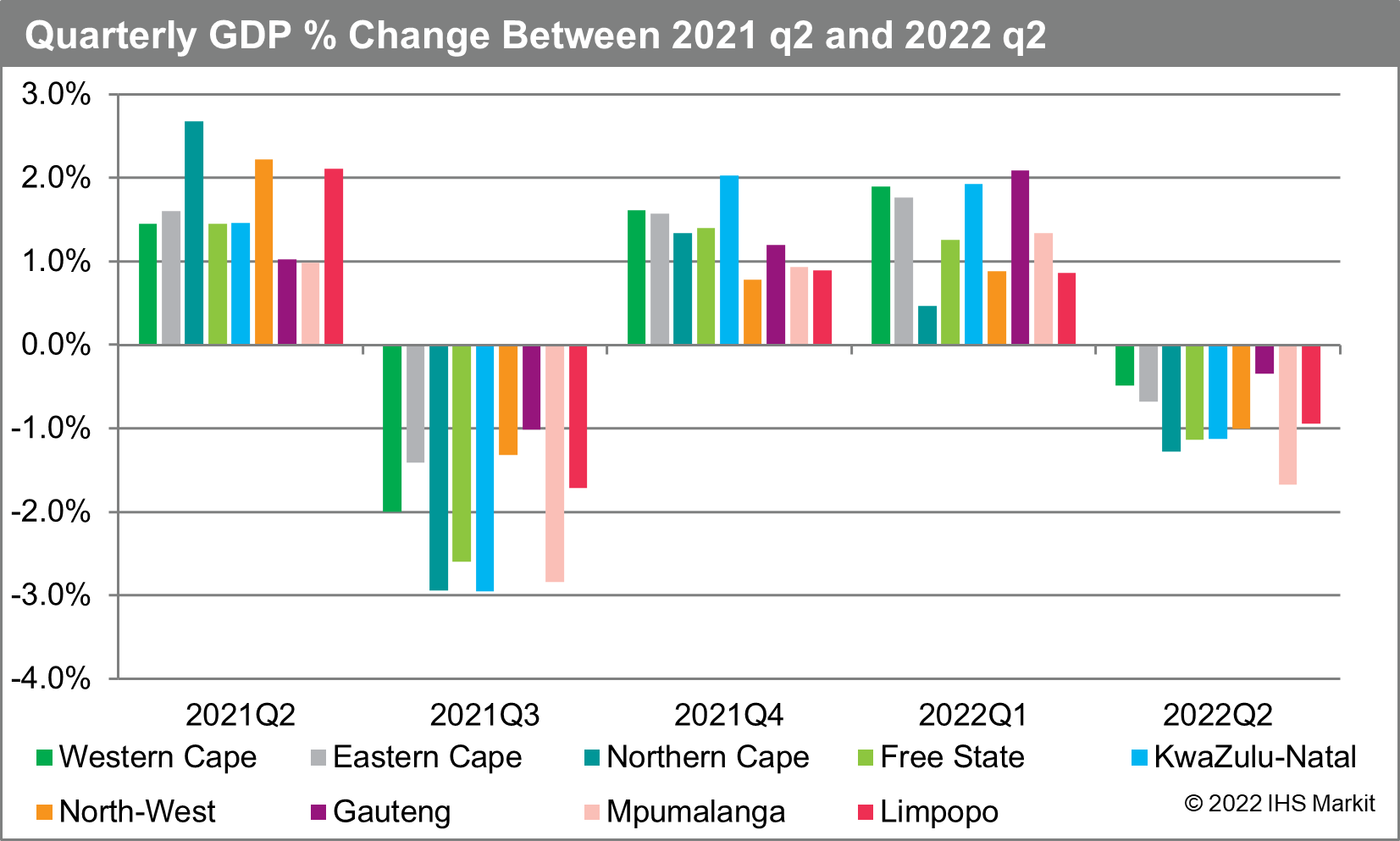

A bounce-back in real GDP is expected for the third quarter 2022. This is after a period of slowdown in economic activity by 0.7% during the second quarter, caused by severe floods in the KwaZulu-Natal (KZN) province and more frequent and longer electricity disruptions.  However, it is expected that in 2023 the real GDP will slow down to a rate of 1.4%. Overall, KwaZulu-Natal’s quarterly GDP is not the lowest out of all nine provinces considering the floods that took place during this period. Mpumalanga experienced the largest decrease in GDP for quarter 2 while Gauteng had the smallest decrease.

However, it is expected that in 2023 the real GDP will slow down to a rate of 1.4%. Overall, KwaZulu-Natal’s quarterly GDP is not the lowest out of all nine provinces considering the floods that took place during this period. Mpumalanga experienced the largest decrease in GDP for quarter 2 while Gauteng had the smallest decrease.

The manufacturing sector contributed a -0.7 point percentage contribution to the growth of GDP for quarter three. This is due to the reported GDP decrease of 5.9%. This is not the only sector reporting a decrease in its GDP for the quarter. Agriculture, mining and quarrying, trade, catering and accommodation, and construction all increased a decline in their GDP between the two quarters.

The recovery in economic activity during the third quarter is expected to be shallow, reflecting pressure on household spending and less inventory build-up. Growth in fixed investment should continue, a result of ongoing pent-up post-COVID-19 demand. The disposable income of households will suffer from high food and fuel inflation and further increased interest rates.

South African Macroeconomic Outlook

The rand exchange rate is expected to end 2022 at ZAR16.50–ZAR16.80/USD1.00, weaker than initially expected. The year-end rand exchange-rate expectation was revised downward to an estimated ZAR16.50–16.80/USD1.00. In the medium term, price differentials with the rest of the world, movements in commodity prices, the current-account deficit, and the level of international reserves will determine the rand’s level. South Africa has a high import propensity of 28.0% of GDP, which with its slow-developing and relatively fragile export markets, should keep external accounts in the red and place downward pressure on the rand. In addition, the South African Reserve Bank has started a normalization cycle with both the policy and repo rate increasing by 25 basis points in March, 50 basis points in May, and 75 basis points in July. Finally, it is expected for headline inflation to average 6.8% in 2022 with inflation expected to exceed the target range during the second and third quarters of 2022.

The South African government announces far-reaching energy reforms that could unlock additional electricity supply over the medium term. The South African government announced a series of policies to address the country’s electricity deficit. Solutions to state-power-provider Eskom’s operational instabilities have been put into action, while the allocation of the next renewable procurement round has been doubled from 2,600 megawatts (MW) to 5,200 MW. Eskom’s primary focus on stabilization policies consisted of an increase in Eskom’s maintenance budget, the appointment of capable and skilled leadership at the power stations, and seeking solutions to Eskom’s ZAR400-billion debt. Although the recently announced measures will not have an immediate impact on South Africa’s dire electricity backdrop, prospects of medium-to-longer-term added capacity to the grid have improved.

Broadening localization strategy to boost South Africa’s post-COVID-19 economic recovery raises inflation risk over the medium term. South Africa’s post-COVID-19 pandemic recovery plan extends the government’s focus on building local industrial capacity for the domestic market and for export markets through the introduction of the revised localization strategy. The new strategy asks for all local businesses to substitute 20% of their nonpetroleum imports with locally produced goods within the next five years. However, the South African government’s revised localization policies could have unintended consequences over the medium term. Protecting, diversifying, and deepening South Africa’s manufacturing base will require more than just a strong localization drive. It will also require a comprehensive overhaul of infrastructure availability, education outcomes, and strengthening of municipal-level capacities in the delivery of basic services.

Eskom announces widespread rolling power outages, worsening downward pressure on business activity in South Africa. The state-owned electricity utility elevated its load-shedding program to ‘Stage 6’ in late June 2022. The increased load shedding implies significant damage to South African economic activity, as various parts of the country will experience power outages for at least eight hours per day on a rotating basis. The power deficit in the South African economy is unlikely to ease by the end of 2022. This primarily reflects continued delays in the Risk Mitigation Independent Power Producer Procurement Program (RMIPPPP). The RMIPPPP is an emergency program intended to fill the short-term gap in electricity supply. RMIPPPP has faced legal challenges after the majority were awarded to Karpowerships SA, favoring gas-to-power generation and tying the South African government into an expensive 20-year contract. Continued electricity disruptions will hinder South Africa’s growth opportunities as it is expected for 2023, GDP growth will likely slow to 1.4%, before improving to 1.8% annually by 2025, with little prospect of reducing high unemployment or the widening inequality gap. The risk of social unrest will probably remain elevated and could result in further sporadic reductions in economic activity, as indicated by the recent illegal strike and sabotage at strategically important coal-fired power stations and their associated economic costs.

Nonetheless, South Africa remains one of the most developed economies in the sub-Saharan region. South Africa’s tax collection systems still rank among the best in the world. The same applies to the highly developed and well-regulated financial system, which includes the Johannesburg Stock Exchange (JSE). Although infrastructure bottlenecks have become apparent in recent years, the country’s road, rail, and port facilities are the most developed in the region. The judicial system remains solid and the skills pool diversified while high-ranked tertiary institutions position South Africa well to reap the benefits of regional economic strength in the coming years. Unlocking the country’s renewable energy potential could place the economy on a stronger growth trajectory in the longer term.

Main data release incorporated in this update

ReX has been updated with the latest data available from StatsSA, SARB, SARS, and many more which allowed us to further update 2021 data on a sub-national level for most modules in ReX.

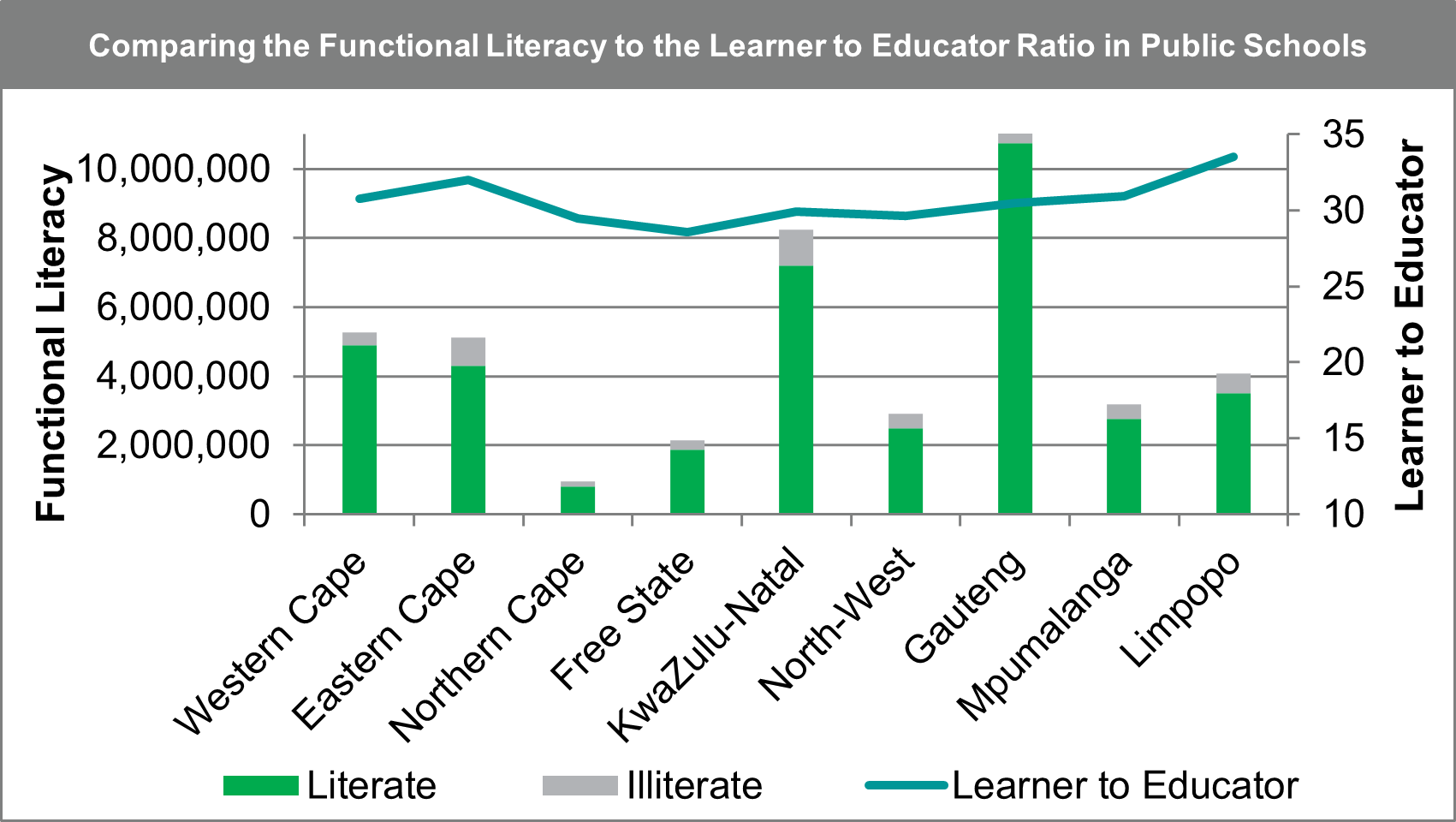

We are excited to announce the addition of three new variables under our Geographic (previously Environment) Module. The data relates to important educational ratios namely, the Average Number of Educators per Facility, Average Number of Learners per Facility, and Learner to Educator ratio. The data was obtained from the Department of Education EMIS database and covers the years from 2007 to 2021. The three ratios can be drilled down to view the data in Educational Sector and Educational Phase.

Experts in the field deem there is a link between Learner to Educator Ratio and the number of people who drop out of school before grade 9. Mpumalanga has one of the highest LERs while having the largest portion of their population above the age of 15 being illiterate. Similar can be said for Limpopo, with a 14% illiterate rate and 34 learners for one educator

The quarterly Gross Domestic Product was updated and includes both annualised and unannualised growth rates. The quarters are seasonally adjusted to remove all seasonal effects before its annualised. This method assumes that the percentage change from one quarter to the following quarter will be maintained for the entire year. This method has its advantages as it allows for previous annual movements to be directly compared and it allows for forecasting to provide a macroeconomic framework to make necessary decisions. It is important to note that during periods of extreme spikes or drops, both the annualised and unannualised values are used together. Stats SA announced in 2021 that they will no longer use the annualised rate as the headline rate of change, however, we will continue to release these figures in our quarterly releases. To get a greater understanding of why StatsSA moved away from the annualised rate, refer to the following article.

Unfortunately, we have not been able to update ReX’s Fiscal Module to include the latest mSCOA classification that was released by the National Treasury earlier this year. If you require the latest Fiscal data, please contact us and we can make an arrangement.

Enjoy the update!

The IHS Markit ReX team