2023q3

Regional eXplorer (ReX) update – 3rd quarter of 2023

IHS Markit is glad to announce the third quarter update for 2023 of Regional eXplorer (ReX) – the South African knowledge base of municipal-level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

In this newsletter:

In this newsletter:

- South Africa’s real GDP growth is expected to average 0.4% in 2023.

- South African Macroeconomic outlook

- Main data release incorporated in this update

South Africa's real GDP growth is expected to average 0.4% in 2023

South Africa’s second-quarter real GDP exceeded expectations, increasing by 0.6% quarter over quarter from 0.4% in the first quarter of 2023. A strengthening in real capital formation underlined the GDP growth surprise. However, the real GDP growth estimate for 2023 remains unchanged at 0.4%. Maintaining strong upward momentum in real capital formation during the second half of 2023 could leave South Africa’s real GDP growth closer to 0.7% instead.

Fixed investment spending in machinery and equipment, which accelerated by 11% quarter over quarter. South Africa’s widening electricity deficit has most likely attracted investment into emergency power supply infrastructure by households and local businesses in recent months. Large energy users like mines made use of the suspension of the licensing threshold for private power generation projects and installed emergency electricity infrastructure.

The newly appointed Electricity Minister, Kgosientsho Ramokgopa’s short-term action plan to alleviate power disruptions in the economy will revolve around the rehabilitation of existing coal-fired power plants thus utilizing emergency reserves and electricity imports. Unlocking financing to the amount of 34 billion rand for renewable energy projects under Bid Window 5 and 12 billion rand under Bid Window 6 is also under our baseline. South Africa lacks sufficient distribution infrastructure, which continues to be a drag on renewable energy and embedded power generation projects in the country.

The Net Trade will likely show a negative contribution to South Africa’s GDP during 2023. The weaker economic prospects for advanced economies, particularly mainland China and the eurozone, will curtail South Africa’s export performance while sluggish domestic demand will likely suppress import volumes during 2023.

Household consumer spending fell by 0.3% quarter over quarter during the second quarter of 2023, Statistics South Africa (Stats SA) reported. High inflation, interest rates and unemployment rate (now at 32.6%) have been detrimental to consumer confidence, which remains 16 points below the neutral level of zero in the third quarter of 2023.

South African Macroeconomic Outlook

The rand exchange rate remains weak against the US dollar. The rand has weakened by 15.4% against the US dollar during the first nine months of 2023 and reflects a widening current-account deficit. Furthermore, adverse investor sentiment which was spurred by the deepening electricity crisis in the South African economy.

The South African Reserve Bank (SARB) hiked it policy rate by a further 50 basis points. The rate is currently 8.25% set during the May Monetary Policy Committee meeting. Maintaining a wide interest rate differential with developed economies to attract much necessary portfolio inflows while anchoring medium-term inflation expectations with the SARB’s inflation target range of 3% - 6%, underlines the interest rate outlook.

Inflation should stay at about 4.5% - 5.0% with global inflation at about 2.0% - 2.5%. This scenario leaves the inflation differential at approximately 2.0% - the expected rate of depreciation for the rand in the longer term. Price differentials with the rest of the world, movements in commodity prices, the current account deficit, and the level of international reserves will determine the rand’s level. South Africa has a high import propensity of 28.0% of GDP, which, with its slow developing and relatively fragile export markets, should keep external accounts in the red and place downward pressure on the rand.

The government’s consolidated budget deficit is unlikely to meet the South African government’s fiscal deficit target of 4.2% for fiscal year 2023-24. S&P Global’s estimates suggest that the budget deficit will widen to 5.6% of GDP with the risk skewed to the downside. Budget overruns emanating from above-estimated public-sector wage increases, above-budget financial support to state-owned entities such as power producer Eskom, and weaker real GDP than initially expected underline the expectation.

South Africa’s infrastructure bottlenecks go beyond electricity. South African mining exports failed to benefit fully from the strong rebound in global commodity prices during 2022 as rail operations of state-owned railway operator Transnet have experienced vandalism, sabotage, and a shortage of locomotives. Furthermore, we expect increasing incidences of water shortages to continue, affecting the mining, agriculture, automobile, and energy sectors, all of which heavily use water.

Downside Risks. The government delays government spending rationalization programs. Public-sector debt levels escalate above current expectations, triggering further sovereign credit risk downgrades by international rating agencies, crowding out public investment, and deterring long-term growth prospects. Additionally, “Populist” policies such as land redistribution disrupt the agricultural production supply chain and jeopardize property rights in the economy. Next, the impact of rising bond yields in the developed world results in a sharp swing in portfolio flows out of emerging markets, including South Africa. Such an outcome could mean higher inflation and interest rates than the baseline assumption. Lastly, South African lost preferential trade access to the US under the African Growth and Opportunity Act (AGOA) due to the increasingly strained US-South Africa political relationship. The US suspends financing for the South Africa renewable energy program.

Upside Risks. Under the leadership of Ramaphosa, the South African government may launch a series of reforms and policy actions to address the weaknesses in the education system, loss in international competitiveness, the mining charter and the financial viability and leadership of SOEs. Additionally, International commodity prices move above the baseline outlook, which improves the growth and exchange rate outlook in the South African economy. The government has been partially successful in attracting 100 billion dollars in local foreign investments in the next five years.

Main data release incorporated in this update

ReX has been updated with the latest data available from StatsSA, SARB, SARS. The main data updates from the past quarter included the latest General Household Survey (GHS 2022), Domestic Tourism Survey (DTS 2020 & 2021), Quarterly Labour Force Survey (QLFS 2023Q2), Fuel Sales Volumes for 2022 and the Quarterly National GDP.

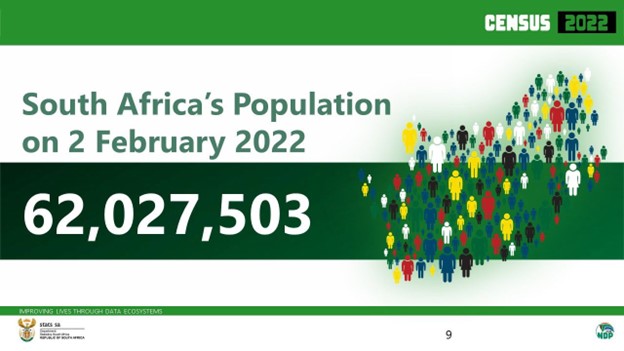

Population Census 2022 Update

Stats SA announced the latest population figures on Tuesday the 10th of October as well as the Post-enumeration Survey (PES). Key findings from the PES 2022 are: The estimated South African population is 62,0 million persons on the Census 2022 reference night. The estimated final true population from private dwelling units within the scope of the PES 2022 is 61,4 million persons. This estimate is based on the adjustment of Census 2022 data using the adjustment factors derived under the PES 2022. The Census 2022 count of those in-scope for enumeration is 42,3 million persons. The uncorrected census count estimated by PES 2022, is 43,9 million persons. The final net coverage error rate relative to the final true population of 61,4 million persons is thus 31,1%. Stats SA has indicated they will release the results in a phased approach, the first part of the results provided data down to a local municipal level. We are still awaiting final confirmation of the more detailed level data. These results will be incorporated into ReX during the next release expected by the end of November 2023.

Provincial GDP Estimates

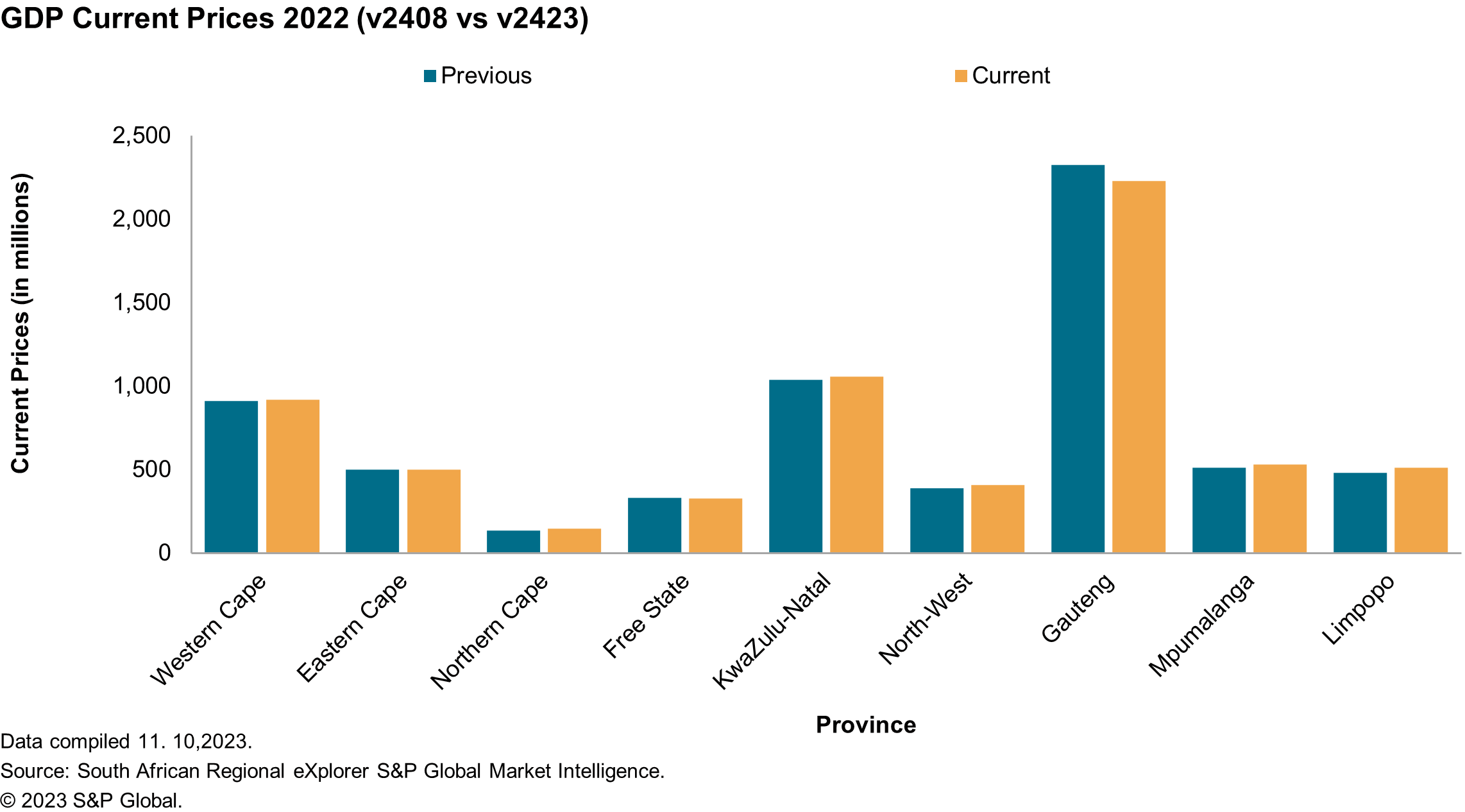

StatsSA recently published an experimental discussion document on the estimation of provincial GDP for 2013 through to 2022 with the data covering nominal and real prices. Although they have emphasized that these are experimental estimates and invite suggestions on the improvement of their methodology, we have incorporated these figures in addition to our estimates. Over the past quarter, the new data releases have also seen some adjustments being made to our provincial-level GDP estimates beyond 2022 into our forecasted years.

In the latest version of ReX (v2423), the experimental estimates were added to the model. The above graph illustrates the slight adjustments in GDP per province to that of the previous version (v2408). There were no significant differences between the 2 versions, with Gauteng being the only province with a noticeable decrease in its 2022 GDP from the previous version to the current. Most of the remaining provinces such as Western Cape and KwaZulu-Natal have slight increases in their GDP estimates. Overall, the Northern Cape saw the highest change in its provincial GDP due to the inclusion of the StatsSA experimental change. The Northern Cape had an adjustment of 9% in the provincial GDP.