2023q4

Regional eXplorer (ReX) update – 4th quarter of 2023

S&P Global is glad to announce the fourth quarter update for 2023 of Regional eXplorer (ReX) – the South African knowledge base of municipal-level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

In this newsletter:

- Downside pressure on the rand exchange rate expected to persist during 2023

- Medium and long-term outlook

- Near-term outlook

- Main data release incorporated in this update

Downside pressure on the rand exchange rate expected to persist during 2023

The rand has lost more than 6% of its value against the US dollar since May 4, leaving the currency at an all-time low of 19.37 rand/$1.00 on May 23. The rand furthermore has lost more than 3.5% of its value against the euro and pound over the period. Few other emerging market currencies followed the rand’s trend, suggesting that idiosyncratic factors are primarily responsible for the recent rand slide. The rand exchange rate deprecation gained momentum after the US ambassador to South Africa, Ambassador Reuben Brigety, announced on May 11 that US officials are ‘confident’ that the South African government has supplied weapons and ammunition to Russian authorities. Ambassador Brigety stated that the supply of weapons and ammunition to Russia was “fundamentally unacceptable” for the US and contradicted South Africa’s stated non-aligned status toward Russia’s war against Ukraine.

However, downward pressure on the rand exchange rate has already prevailed since the start of 2023. Sentiment toward South Africa took a turn for the worse after it became apparent that electricity disruptions could escalate during the Southern hemisphere winter months. The gray listing of South Africa by the Financial Action Task Force also contributed to the worsening investor sentiment toward the country.

A deterioration in South Africa’s terms of trade of 2.6% during 2022 and a further 0.2% year over year during January– February 2023, combined with a fall in export volumes, will furthermore increase pressure on the current account. The country’s pivot away from renewable energy infrastructure investment toward rehabilitation of the ailing coal-fired power stations to address the pressing electricity needs will derail short- to medium-term foreign direct investment, in our view. This will leave current account financing more reliant on “other investment” — particularly loans — or a drawdown in foreign reserves in the near term.

Negative market sentiment, tighter global financial market conditions and worsening current-account position, combined with increasing prospects for a change in South Africa’s credit risk outlook to Negative from Stable, will keep the currency under pressure. We expect the rand to trade at around 19.00-18.70 to the US dollar until mid-2023. Only a significant shift in sentiment, underpinned by ongoing fiscal consolidation, narrowing interest rate differentials and/or improvement in domestic electricity supply will bring the rand closer to 17.80 to the US dollar, a level unlikely to be seen before year-end.

Medium and long-term outlook

The rand exchange rate remains weak against the US dollar. The rand has weakened by 15.4% against the US dollar during the first nine months of 2023 and reflects a widening current-account deficit. Furthermore, adverse investor sentiment which was spurred by the deepening electricity crisis in the South African economy.

The South African Reserve Bank (SARB) hiked it policy rate by a further 50 basis points. The rate is currently 8.25% set during the May Monetary Policy Committee meeting. Maintaining a wide interest rate differential with developed economies to attract much necessary portfolio inflows while anchoring medium-term inflation expectations with the SARB’s inflation target range of 3% - 6%, underlines the interest rate outlook.

Inflation should stay at about 4.5% - 5.0% with global inflation at about 2.0% - 2.5%. This scenario leaves the inflation differential at approximately 2.0% - the expected rate of depreciation for the rand in the longer term. Price differentials with the rest of the world, movements in commodity prices, the current account deficit, and the level of international reserves will determine the rand’s level. South Africa has a high import propensity of 28.0% of GDP, which, with its slow developing and relatively fragile export markets, should keep external accounts in the red and place downward pressure on the rand.

The government’s consolidated budget deficit is unlikely to meet the South African government’s fiscal deficit target of 4.2% for fiscal year 2023-24. S&P Global’s estimates suggest that the budget deficit will widen to 5.6% of GDP with the risk skewed to the downside. Budget overruns emanating from above-estimated public-sector wage increases, above-budget financial support to state-owned entities such as power producer Eskom, and weaker real GDP than initially expected underline the expectation.

South Africa’s infrastructure bottlenecks go beyond electricity. South African mining exports failed to benefit fully from the strong rebound in global commodity prices during 2022 as rail operations of state-owned railway operator Transnet have experienced vandalism, sabotage, and a shortage of locomotives. Furthermore, we expect increasing incidences of water shortages to continue, affecting the mining, agriculture, automobile, and energy sectors, all of which heavily use water.

Downside Risks. The government delays government spending rationalization programs. Public-sector debt levels escalate above current expectations, triggering further sovereign credit risk downgrades by international rating agencies, crowding out public investment, and deterring long-term growth prospects. Additionally, “Populist” policies such as land redistribution disrupt the agricultural production supply chain and jeopardize property rights in the economy. Next, the impact of rising bond yields in the developed world results in a sharp swing in portfolio flows out of emerging markets, including South Africa. Such an outcome could mean higher inflation and interest rates than the baseline assumption. Lastly, South African lost preferential trade access to the US under the African Growth and Opportunity Act (AGOA) due to the increasingly strained US-South Africa political relationship. The US suspends financing for the South Africa renewable energy program.

Upside Risks. Under the leadership of Ramaphosa, the South African government may launch a series of reforms and policy actions to address the weaknesses in the education system, loss in international competitiveness, the mining charter and the financial viability and leadership of SOEs. Additionally, International commodity prices move above the baseline outlook, which improves the growth and exchange rate outlook in the South African economy. The government has been partially successful in attracting 100 billion dollars in local foreign investments in the next five years.

Near-term outlook

South Africa’s real GDP growth should average 0.7% in 2023 as fixed investment and consumer spending taper during the second half of the year. South Africa’s second-quarter real GDP exceeded expectations, increasing by 0.6% quarter over quarter from 0.4% quarter over quarter in the first quarter of 2023. Our overall real GDP growth estimate for 2023 is revised upward to 0.7% as a result. Fixed investment spending in machinery and equipment — which accelerated by 11% quarter over quarter — combined with a 58.9-billion-rand build-up in inventories, was primarily responsible for the sharp accumulation in real capital formation during the second quarter. The importation of machinery and equipment reached a peak in June, latest numbers of the South African Revenue Service (SARS) shows, suggesting that the rebound in fixed investment spending could start to taper in the third quarter. Household consumer spending fell by 0.3% quarter over quarter during the second quarter of 2023, Statistics South Africa (Stats SA) reported. High inflation, interest rates and unemployment rate (now at 31.9%) have been detrimental to consumer confidence, which remain 16 points below the neutral level of zero in third quarter 2023. Weak consumer confidence could derail durable consumer spending, particularly for interest rate-sensitive consumer items such as residential fixed investment and passenger vehicle sales from the second half of 2023 onward.

Newly appointed Electricity Minister Kgosientsho Ramokgopa’s short-term action plan to alleviate power disruptions in the economy will revolve around the rehabilitation of existing coal-fired power stations, utilizing emergency reserves like pumped storage facilities and open-cycle gas turbines, and electricity imports from a 415 MW Karpowership power stations. South Africa lacks sufficient distribution infrastructure, which continues to be a drag on renewable energy and embedded power generation projects in the country. Electricity disruptions resumed in September 2023 after a relatively stable electricity supply during the second quarter.

The 2023 – 24 fiscal deficit target is outside of reach due to revenue underperformance and spending overruns. South Africa lacks sufficient distribution infrastructure, which continues to be a drag on renewable energy and embedded power generation projects in the country. Electricity disruptions resumed in September 2023 after a relatively stable electricity supply during the second quarter. The decline reflected a widening current account deficit and adverse investor sentiment, which was spurred by the deepening electricity crisis in the South African economy, fiscal debt concerns and uncertainty over South Africa’s future relations with Russia. South Africa has a high import propensity of 28.0% of GDP, which, with its slow developing and relatively fragile export markets, should keep external accounts in the red and place downward pressure on the rand. Inflation should stay at about 4.5% - 5.0%, with global inflation at about 2.0%-2.5%. This scenario leaves the inflation differential at approximately 2.0% — the expected rate of depreciation for the rand in the longer term. The South African Reserve Bank (SARB) hiked its policy rate by a further 50 basis points to 8.25% during the May Monetary Policy Committee meeting. Maintaining a wide interest rate differential with developed economies to attract much necessary portfolio inflows.

Main data release incorporated in this update

ReX has been updated with the latest data available from StatsSA, SARB, SARS. The main data updates from the past quarter included the latest Quarterly Crime Statistics Quarterly Labour Force Survey (QLFS 2023Q3), Quarterly National GDP and updated Tourism data using the SAT and TSA data.

Additional Trade Blocs

In the latest ReX update, additional Trade Blocs have been added under the International Trade module. In addition to APE, EFTA, EU, MERCOSUR, NAFTA and SADC nine other African trade blocs were added, namely:

|

Name |

Acronym |

Countries |

|

Common Market for Southern and Eastern Africa |

COMESA |

Burundi, Comoros, Djibouti, Egypt, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Sudan, Tunisia, Uganda, Zambia and Zimbabwe. |

|

East African Community |

EAC |

Burundi, Democratic Republic of Congo, Kenya, Rwanda, South Sudan, Uganda and United Republic of Tanzania. |

|

Economic Community of Central African States |

ECCAS |

Angola, Burundi, Cameroon, Central African Republic, Chad, Congo, DR Congo, Equatorial Guinea, Gabon, São Tomé and Príncipe and Rwanda |

|

Economic Community of West African States |

ECOWAS |

Benin, Burkina Faso, Cabo Verde, Côte d’Ivoire, Gambia, Ghana, Guinea, Guinea Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo |

|

Arab Maghreb Union |

UMA |

Algeria, Libya, Mauritania, Morocco and Tunisia. |

|

Community of Sahel–Saharan States |

CEN-SAD |

Benin, Burkina Faso, Cabo Verde, Central African Republic, Chad, Comoros, Côte d’Ivoire, Djibouti, Egypt, Eritea, Gambia, Ghana, Guinea, Guinea Bissau, Kenya, Liberia, Libya, Mali, Mauritania, Morocco, Niger, Nigeria, São Tomé and Príncipe, Senegal, Sierra Leone, Somalia, Sudan, Togo, and Tunisia |

|

Intergovernmental Authority on Development |

IGAD |

Djibouti, Eritea, Ethiopia, Kenya, Somalia, South Sudan, Sudan, and Uganda |

|

International Conference on the Great Lakes Region |

ICGLR |

Angola, Burundi, Central African Republic, Congo, DR Congo, Kenya, Rwanda, South Sudan, Sudan, Uganda, Tanzania and Zambia |

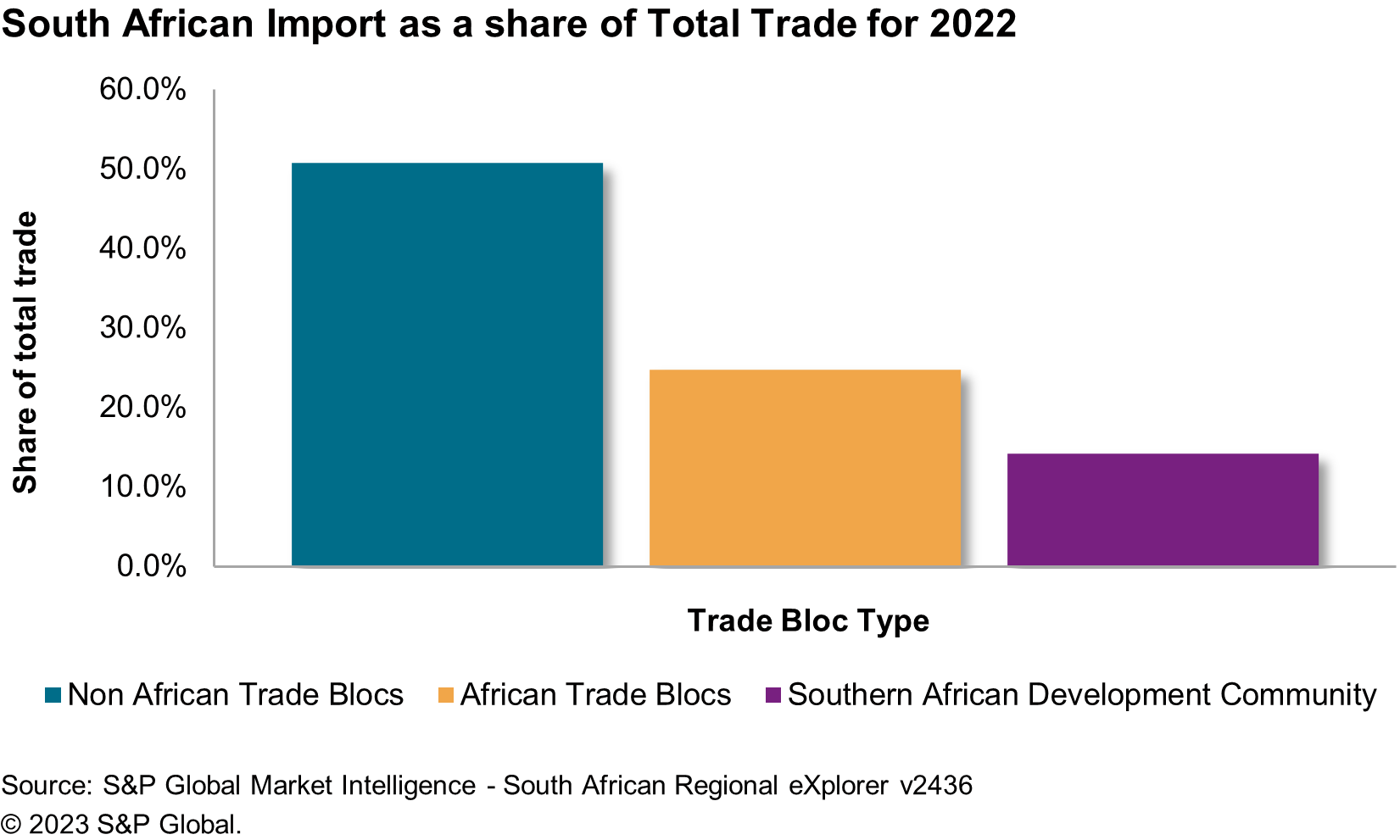

South Africa only forms part of the Southern African Development Community Trade (SADC) and within the Trade Bloc South Africa tended to export more than it imported to other countries within in Trade Agreement for the period of 2022. When looking at Trade Blocs that fall outside of the African Union namely; ASEAN, MERCOSUR, APEC, EFTA, EU, and NAFTA; South Africa’s Import to Export ratio is almost equal with imports being marginally higher than exports for these trade blocs in 2022. The new trade blocs added within ReX were all African Trade Blocs of which South Africa exports to these regions significantly more than they import products from these countries.

Population Census 2022 Update

Stats SA has indicated they will release the results in a phased approach, the first part of the results provided data down to a local municipal level was released in October 2022. Stats SA has in the interim reported that the next phase which will cover more detailed data in terms of the number of questions covered as well as the spatial resolution will only be released in early April.

As long-time users would know, we at S&P Global produce independently modeled population estimates. These estimates make use of the Cohort-Component Population Projection method which is a class of models that are known for their ability to accurately preserve the structure of a population as it grows over time. These models make use of population fundamentals (births, deaths, migration etc.) to project a population as it experiences changes.

StatsSA follows a similar approach with their assumptions to produce their Mid-Year Population Estimates. On the other hand, a Census is a complete count of a population which is accompanied by a Post Enumerated Survey to adjust the levels if there has been a significant under-count.

In the next section, we will compare the results from ReX’s demographic model with that of the latest Mid-Year Population Estimate (MYPE) as well as the Census 2022 population results:

At national level the results indicate that the ReX model was closer to the Census results when compared with the 2022 MYPE.

On a provincial level, the ReX estimates have produced closer estimates to the census results when compared with the MYPE. The most significant changes can be seen through a lower population for Gauteng and higher population counts in KwaZulu-Natal, Mpumalanga, and Limpopo, while the other provinces have remained relatively the same.

In terms of the next steps, the population estimates within ReX are being updated continually. Recently StatsSA released two new vital statistic additions namely, the “2022 - Number of Live Births” and the “2019 - Cause of Deaths”. Only the publications and high-level figures have been released at the moment and we still await the detailed unit-level data in January, but these form crucial inputs into the cohort-component model as discussed above. As we incorporate these inputs and review the whole demographic model, we aim to produce newly updated Population estimates in the first quarter release of ReX in 2024.