2024q2

Regional eXplorer (ReX) update – 2nd quarter of 2024

S&P Global is glad to announce the second quarter update for 2024 of Regional eXplorer (ReX) – the South African knowledge base of municipal-level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

In this newsletter:

1. South Africa’s real GDP growth should accelerate to 1% in 2024 from an estimated 0.6% in 2023.

2. Medium-and long-term outlook

4. Main data releases incorporated in the update

South Africa’s real GDP growth should accelerate to 1% in 2024 from an estimated 0.6% in 2023.

S&P Global Market Intelligence analysts have lowered South Africa’s real GDP growth prospects for 2024 to 1% as dry El Niño weather conditions constrain agricultural production in the short term. The El Niño-related rain deficit during the latter part of the 2023/24 agriculture crop season is expected to leave summer grain production more than 21% below the 2022/23 harvest, estimates produced by the Crop Estimates Committee show. The harvest is still sufficient to meet domestic demand, but exports of agriculture-related products will slow during 2024. Fewer electricity disruptions and introducing the two-pot pension reforms in the fourth quarter of 2024 could offset the expected agricultural sector weakness during the first half of the year.

Negative consumer sentiment, falling real disposable income, persistently – high interest rates, and weak household credit extension combined with a slowing job market will keep private household spending sluggish during 2024. The introduction of the two-pot pension reform system during September 2024 will allow consumers access to an early portion of their pension savings pot, with an initial maximum amount of 25,000 rand ($1,340). The pension reforms could spur stronger household spending during the fourth quarter of 2024, with the durable and semidurable consumer categories expected to benefit the most. The private-sector fixed investment will continue to find support from the renewable energy infrastructure expansion programs and policy reforms, with S&P Global Commodity Insights projections showing ongoing wind, solar, and central power expansion investment under the Risk Mitigation Power Procurement Program and the Renewable Independent Power Producer Program. The Electricity Regulation Amendment Bill was passed by the National Council of Provinces (NCOP) in May 2024 and is now ready to be signed into law. The new bill will allow South Africa’s power sector to transition into a multimarket model for electricity trading and the unbundling of state power producer Eskom into transmission, generation, and distribution divisions. Eskom’s Energy Availability Factor (EAF) jumped to a remarkable 70% in May 2024. A significant drop in unplanned outages by 4,400 MW since April 2024 contributed to the stronger EAF performance.

A rebound in prices of South Africa’s key exporting commodities such as platinum combined with stronger global economic growth expected for 2024 (2.7%, unchanged from 2023), will partly offset the impact of the ongoing transport infrastructure bottlenecks on South Africa’s export performance during 2024. In March 2024, state logistics provider Transnet Freight Rail (TFR) announced that the state-controlled railway network will be opened to private sector participation under Public-Private Partnerships. The benefits of this reform on transport bottlenecks will be only visible toward the end of 2024–25, should legislation be implemented successfully and private sector bidders enter the market.

Medium-and long-term outlook

South Africa’s medium- to long-term prospects hang in the balance. To stem the economic slide will require policy reforms, stronger institutions, renewed private sector investor interest, and a build-back infrastructure rehabilitation and development programs. Instead, the country’s current development roadmap is outdated and has been overshadowed by inefficiencies, a deepening rent-seeking society, limited fiscal flexibility, loss of infrastructure, and rising unemployment and poverty levels in the country. Political will is needed to implement growth-supportive reforms while addressing state inefficiency and corruption. This has become a difficult task for the ruling African National Congress (ANC), who is progressively losing electoral support. The next election is scheduled for 2024. The country will furthermore become more vulnerable to adverse climate events, particularly floods, and droughts, the loss of production and trade due to adverse energy policies, such as coal-fired electricity generation, and higher inflation due to localization policies.

The lack of access to reliable electricity is a massive drag on South Africa’s potential growth, which is set at 0% in 2023. Rolling blackouts have been prevalent in the economy since 2015 but gained significant momentum in 2022–23. Central bank estimates show that electricity disruptions of about 6 to 12 hours a day (load shedding stage 3 to 6) detract around 204 million-899 million rands from daily economic activity. Potential growth is furthermore capped by weak total factor productivity growth and a smaller contribution from the labor market as unemployment levels accelerate to 36%. Capital accumulation improved somewhat during 2021–22 but was highly concentrated in the trade and, to a lesser extent, the mining industries.

Electricity rehabilitation and production expansion programs could lift potential growth to 1.5%. South Africa’s widening electricity deficit will likely attract the most investment interest from households and local businesses in the short term. Large energy users such as mines, manufacturers, and the health industry will continue to make use of the suspension of the licensing threshold for private power generation projects. Unlocking financing to the amount of 34 billion rands for renewable energy projects (solar and wind) under Bid Window 5 and 12 billion rands under Bid Window 6, combined with the development of South Africa’s offshore natural gas deposits, is nonetheless essential to sustain and expand South Africa’s electricity capacity over the medium to long term. South Africa lacks sufficient distribution infrastructure, which continues to be a drag on the renewable energy and embedded power generation projects in the country. Expansion of private business and household energy infrastructure could leave potential growth at around 1.5% over the medium term.

We maintain a long-term growth projection of 2.5%. Achieving this potential growth objective — which will allow for a consistent improvement in real per capita income for the general population — will require a much broader private sector participation to overall fixed investment. Businesses will expand operations to benefit from preferential access under the African Continental Free Trade Agreement (AfCFTA), investing in renewable energy projects, South Africa’s vast critical minerals deposits, expanding tourism industry, and highly developed financial and other business services, including technology. South Africa’s tax collection systems still rank among the best in the world. The same applies to the highly developed and well-regulated financial system, which includes the Johannesburg Stock Exchange (JSE). Although infrastructure bottlenecks have become apparent in recent years, the country’s road, rail, and port facilities are the most developed in the region. The judicial system remains solid and the skills pool diversified, while high-ranked tertiary institutions position South Africa well to reap the benefits of the regional economic strength foreseen in coming years.

Risk to the Forecast

Downside risks in the economy remain prevalent in the short term. Possible swings in the global portfolio away from emerging markets to developed economies, along with electricity supply deficits and the introduction of populist policies add to near-term risk factors. Social unrest continues to flare up and disrupt business operations.

The government delays government spending rationalization programs, which include the public-sector wage bill and state-owned enterprise (SOE) inefficiencies. Public-sector debt levels escalate above current expectations, triggering further sovereign credit risk downgrades by international rating agencies, crowding out public investment, and deterring long-term growth prospects.

“Populist” policies such as land redistribution disrupt the agricultural production supply chain and jeopardize property rights in the economy. Ongoing adverse weather conditions pose an additional threat to low food prices, hence raising inflation and lowering purchasing power — with particularly dismal consequences for low-income households. Land redistribution policies destabilize South Africa’s banking sector and trigger substantial asset price depreciation.

A couple of upside risks to the forecast that the South African government launched a series of reforms and policy actions to address the weaknesses in the education system, loss in international competitiveness, the mining charter, and the financial viability and leadership of SOEs. International commodity prices move above the baseline outlook; this improves the growth and exchange rate outlook in the South African economy. The government is partially successful in attracting $100 billion in local and foreign investments in the next five years. This includes electricity-generating investment in renewable programs such as solar, wind, and hydrogen.

Main data releases incorporated in the updated

We incorporated several new data releases into the model during the past quarter.

Household Access to Infrastructure: A few impacted on the new 2023 values for the Household Access to Infrastructure Module including the General Household Survey, Non-Financial Census of Municipalities, Department of Water Affairs National Integrated Water Information System, and South African Waste Information Centre In most regions, there was an increase in the number of dwellings. The possible by-product of these increases is that most regions, besides Western Province, had an increase in the number of “No formal piped water” and Piped water inside dwellings. Meanwhile, the proportions of dwellings in the other three categories remained consistent between 2022 and 2023.

Economic Activity: We updated the model with the latest quarterly GDP figures, as well as the annual updates from the most recent SUT and detailed level industry estimates produced by StatsSA for 2020. The South African GDP decreased by 0.1% in the first quarter with mining and quarrying decreasing by 2,3% overall. Manufacturing and Construction followed with decreases of 1.4% and 3.1 respectively. The agriculture sector performed the best over the quarter reporting a 13,5% increase for 2024Q1 . Similar trends can be seen at a provincial level. Each province reported over 10% increased in the Agricultural sector. Gauteng was the only region to see an increase in the electricity sector while the remaining 8 provinces tended towards minor decreases.

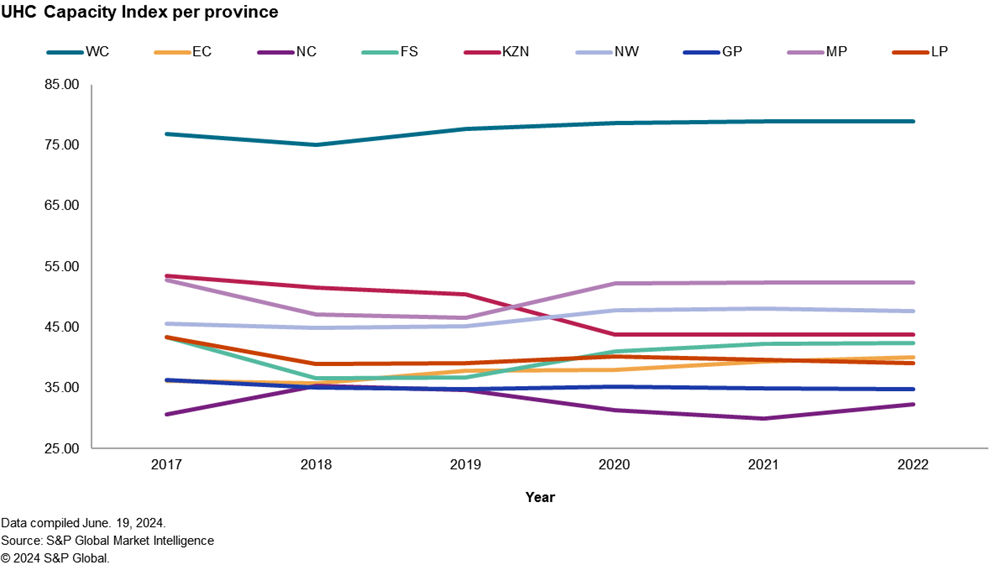

Universal Health Index: This quarter we are glad to announce that we have updated the HST health barometer data into ReX again. After a few years of not releasing any new data, HST released their District-level health barometer again which also contains municipal-level data. Previously the data only covered 2018 and 2019. Now the data goes from 2018 up until 2022, which represents a big increase in the data available. Because we previously removed the health data as it had become outdated, we have included it under a new location within ReX under the Geographic Module. This data is experimental, and we welcome your feedback on the usability of this data. Please direct your comments to evan.burger@spglobal.com.

The Capacity Index under UHC is an index that gives an indication of the facility access, health worker density, and access to essential medicines within a region. The higher the value the better a region is at meeting the SDG 3 more specifically target 3.8. Achieve universal health coverage, including financial risk protection, access to quality essential healthcare services, and access to safe, effective, quality, and affordable essential medicines and vaccines for all. The Western Cape outperforms most of the provinces with an index above the 75 index points.

In 2020, when Covid 19 was rife, most regions saw an increase in their capacity index. This could be due to regions increasing their bed capacities through the implementation of field hospitals (link) and the introduction of a COVID-19 vaccine. However, both Northern Cape and Kwa-Zulu Natal saw a decrease in their index.

Population Census: Lastly, amidst all the new data updates conducted this quarter, we also performed research on Census 2022 investigating its strengths, weaknesses, and overall findings on a municipal level. One of the most interesting findings was the decreased rate of population growth in the City of Johannesburg while the other metros continued their rates of growth (GCRO, 2023).

- We specifically wanted to investigate the notion of City of Johannesburg’s reduction in population size when compared with the consensus of estimated models.

- To make a better estimate on the accuracy of the Census numbers, we conducted a Ratio-Correlation Regression analysis on the regional distribution of population on a municipal level between the three Censuses (2001, 2011 and 2022). We correlated the performance with several administrative data sources for example: number of births and deaths, number of registered voters, Vehicle Registrations, Property Transactions, NOAA Night Lights, number of service delivery units, etc.

- What we have found supported the distributions found in the Census and increases our confidence in the use and accuracy of the Census results. This will take place next quarter as it is a timely process to fundamentally update the underlying structure of the model to be derived from Census 2022 geographies and to align them with past censuses. This process is also highly interlinked to the possibility of Stats SA releasing lower than Municipal level Census 2022 data. If this gets released it will speed up the process.

ReX versus Census 2022: Although the StatsSA Census 2022 is a vital source of socio-economic data in South Africa, there are numerous reasons why using Regional eXplorer as a data source remains vital and independent. Primarily, users should bear in mind that the models use all of the available Census data but include hundreds of other data sources as well. The S&P Global ReX service covers variables that cannot be measured in a Census. Because the Census is a household-side measure, it cannot measure anything from the business side of the economy. Furthermore, there are various questions that the Census does not ask, but which have been modeled into ReX using other data sources. Variables that are available in ReX, but are not available in the latest Census: Gross Domestic Product (GDP), Gross Value Added (GVA), Labour Remuneration, Tourism data, International Trade data, Retail Sales, Gross Operating Surplus, Tress Index, Location Quotient, Crime data, Employment (at place of work).

We are still waiting for the latest Crime stats as well as the release of the data inputs for the Fiscal module to be released. The Financial Census of Municipalities 2023 data is anticipated to be released on the 27th of June, while we do not have an expected release date for the crime data at the time of publishing this newsletter (19th June 2024).