2025q1

Regional eXplorer (ReX) update – 1st quarter of 2025

S&P Global is glad to announce the first quarter update for 2025 of Regional eXplorer (ReX) – the South African knowledge base of municipal-level insight. Each quarter, data from a vast number of sources are incorporated into the ReX database to provide users with the most up-to-date statistics.

In this newsletter:

1. South Africa’s real GDP growth is projected to – rise to 1.7% in 2025.

2. Medium-and long-term outlook

4. Main data release incorporated in the update

South Africa’s real GDP growth is projected to – rise to 1.7% in 2025.

A decline in headline inflation is expected to support a recovery in real household income and consumer spending during first half 2025. Consumer spending is expected to receive a further boost from the implementation of the new two-pot retirement system, which will enable households to access a portion of their pension savings in 2025. Lower interest rates combined with policy reforms in the energy and logistics sectors are expected to support fixed investment. The global environment will be less supportive of South Africa’s growth recovery during 2025.

The two-pot retirement system is likely to – add 0.3 percentage point to 2025’s real GDP growth rate under the assumption of a 50 billion-rand withdrawal of the retirement saving pool in the fourth quarter of 2024, followed by a 20 billion-rand withdrawal spread evenly over the four quarters of the year in 2025, used primarily for consumption instead of debt reduction, research by the South African Reserve Bank (SARB) shows. An improvement in consumer sentiment since the start of 2024 and lower headline inflation combined with further monetary easing will add to the expected rebound in consumer spending during 2025.

Real fixed investment spending in South Africa is projected to grow by 3.3% in 2025, encompassing both the public and private sectors of the economy. The recovery in fixed investment from the public sector and public corporations, which commenced in third quarter 2024, is expected to continue into 2025. This trend is supported by political and policy stability resulting from the establishment of the Government of National Unity (GNU) in June 2024.

Furthermore, public-private partnerships focused on the development of energy, water, railway and port infrastructure, bolstered by ongoing policy reforms in these areas, are expected to attract increased nonresidential private sector investment in the short to medium term. Residential investment is expected to gain from declining interest rates and an uptick in real disposable income levels among households, following a significant contraction of 9% during the first three quarters of 2024.

Rising protectionism and anticipated higher US tariffs are likely to result in underperforming global trade, leading to only a modest increase in South Africa’s export volumes in 2025. The new US administration may renegotiate the Africa Growth and Opportunity Act (AGOA), potentially enforcing stricter rules of origin and limiting covered products like automotives. Alternatively, AGOA could be used to align sub-Saharan African countries with US interests, possibly expanding to include critical minerals. Overall, a projected decline in global oil prices is expected to support South Africa’s terms of trade, with the current-account deficit anticipated to rise to 1% of GDP in 2025, up from 0.6% in 2024.

Medium-and long-term outlook

Robust domestic expenditure is expected to offset global vulnerabilities in the South African economy in 2025, resulting in estimated real GDP growth of 1.7%.

The real GDP growth rate of South Africa is expected to rise to 1.7% in 2025, following a downward revision of the 2024 real GDP growth rate to 0.8%. A decline in headline inflation is expected to support a recovery in real household income and consumer spending during first half 2025. Consumer spending is expected to receive a further boost from the implementation of the new two-pot retirement system, which will enable households to access a portion of their pension savings in 2025. Lower interest rates combined with policy reforms in the energy and logistics sectors are expected to support fixed investment. The global environment will be less supportive of South Africa’s growth recovery during 2025.

The two-pot retirement system is likely to – add 0.3 percentage point to 2025’s real GDP growth rate under the assumption of a 50 billion-rand withdrawal of the retirement saving pool in the fourth quarter of 2024, followed by a 20 billion-rand withdrawal spread evenly over the four quarters of the year in 2025, used primarily for consumption instead of debt reduction, research by the South African Reserve Bank (SARB) shows. An improvement in consumer sentiment since the start of 2024 and lower headline inflation combined with further monetary easing will add to the expected rebound in consumer spending during 2025.

Real fixed investment spending in South Africa is projected to grow by 3.3% in 2025, encompassing both the public and private sectors of the economy. The recovery in fixed investment from the public sector and public corporations, which commenced in third quarter 2024, is expected to continue into 2025. This trend is supported by political and policy stability resulting from the establishment of the Government of National Unity (GNU) in June 2024. Furthermore, public-private partnerships focused on the development of energy, water, railway and port infrastructure, bolstered by ongoing policy reforms in these areas, are expected to attract increased non residential private sector investment in the short to medium term. Residential investment is expected to gain from declining interest rates and an uptick in real disposable income levels among households, following a significant contraction of 9% during the first three quarters of 2024.

Rising protectionism and anticipated higher US tariffs are likely to result in underperforming global trade, leading to only a modest increase in South Africa’s export volumes in 2025. The new US administration may renegotiate the Africa Growth and Opportunity Act (AGOA), potentially enforcing stricter rules of origin and limiting covered products like automotives. Alternatively, AGOA could be used to align sub-Saharan African countries with US interests, possibly expanding to include critical minerals. Overall, a projected decline in global oil prices is expected to support South Africa’s terms of trade, with the current-account deficit anticipated to rise to 1.2% of GDP in 2025, up from 0.9% in 2024.

SARB is anticipated to maintain its monetary easing measures in first half 2025. With headline inflation expected to fall below the midpoint of the 3%-6% target range in the first half of 2025, SARB is likely to lower its policy rate by a total of 50 basis points over the next two Monetary Policy Committee meetings. Low food and transport costs combined with contained service inflation leave headline inflation below the SARB’s inflation objective.

The rand is showing unexpected resilience against the US dollar in early 2025. The rand exchange rate has shown unexpected resilience against the US dollar during the first quarter of 2025. Global investors are reassessing their expectations regarding US monetary policy owing to rising uncertainty about the US economy’s strength, resulting in a weakening of the US dollar. The heightened uncertainty will nonetheless leave the US Federal Reserve cautious in lowering its policy rate. Maintaining a wide US interest rate differential combined with a modest widening in the current-account deficit is likely to leave the rand at around 18.50 rand to the US dollar in 2025, broadly unchanged from end-2024 levels.

Higher taxes and spending cutbacks leave South Africa’s medium-term fiscal plan intact. South Africa’s updated budget proposal introduces a 0.5-percentage-point hike in the value-added tax rate, raising it to 15.5% for fiscal year 2025–26, with an additional 0.5-percentage-point increase planned for fiscal year 2026–27. The budget does not allow for any adjustments in personal income tax bracket creep. The revised income proceeds allow for additional infrastructure spending, the extension of the COVID-19 social relief of distress grant to March 2026 and a 5.5% year-over-year increase in public-sector wages. A fine balancing act between higher taxes and spending adjustments leaves South Africa’s medium-term fiscal plan intact. The budget deficit is expected to fall to an estimated 3.5% of GDP in fiscal year 2027–28. The ratio of public-sector debt to GDP is expected to average 75.1% by then.

Risk to the forecast

The political party participation in the Government of National Unity (GNU) is expected to ensure policy continuation inareas such as fiscal, monetary, energy, transport, labor and mining. The ongoing implementation and broadening of reforms could strengthen South Africa’s near-term prospects beyond the current baseline.

The GNU established after – the May 2024 elections unravel owing to policy diversity and lack of consensus among political parties. President Cyril Ramaphosa resigns, and policy and political uncertainty deter domestic and international sentiment. Policy reforms in energy, transport, mining and labor stall.

Private-sector portfolio and fixed investment are delayed owing to mounting concerns about property rights, social unrest and electricity supply.

Ongoing adverse weather conditions pose a threat to low food prices, and hence risks raising inflation and lowering purchasing power — with particularly dismal consequences for low-income households.

South African loses preferential trade access to the US under the African Growth and Opportunity Act owing to increasingly strained US-South Africa political relationship. The US suspends financing for the South Africa renewable energy program.

The government delays government spending rationalization programs, which include the public-sector wage bill and state-owned enterprise (SOE) inefficiencies. Public-sector debt levels escalate above current expectations, triggering further sovereign credit risk downgrades by international rating agencies, being crowded out of public investment and deterring long-term growth prospects.

An increase in US protectionism, through the adoption of higher tariffs, faster deportation of illegal immigrants combined with the extension of tax cuts, could leave US inflation and interest rates higher for longer and the US dollar stronger than initially expected.

However, there are upside risks to the forecast. Under the new leadership of the GNU, the South African government may launch a series of reforms and policy actions to address the weaknesses in the education system, loss in international competitiveness, the mining charter, and the financial viability and leadership of SOEs. Furthermore, International commodity prices move above the baseline outlook; this improves the growth and exchange rate outlook in the South African economy.

Policy reforms are likely to boost South Africa’s real potential growth rate to 2.3%-2.5% over the long term. The formation of the Government of National Unity (GNU) after the May 2024 elections is set to advance policy reforms in South Africa’s energy, ports and railway sectors, while addressing critical skills shortages through visa reforms. Increased private-sector involvement in renewable energy, port operations and railway access is expected to enhance gross capital formation via infrastructure development, ultimately bolstering South Africa’s long-term growth potential. Additionally, South Africa stands out in Sub-Saharan Africa for its favorable demographic dividend, with a larger working-age population compared to non-working individuals bolstering potential growth over the long term. Businesses are furthermore likely to expand operations beyond infrastructure development to leverage preferential access under the African Continental Free Trade Agreement (AfCFTA), investing in critical mineral deposits, the tourism sector, and advanced financial and technology services.

Political developments continue to pose the biggest risk to South Africa’s long-term prospects. Delays in implementing essential policies to address infrastructural bottlenecks pose a risk to our long-term outlook. While markets welcomed the formation of the GNU in 2024, the potential for a coalition collapse within five years remains a concern. Additionally, policy paralysis may occur due to significant differences in political ideologies regarding growth and ministerial objectives. South Africa is one of the most unequal societies in the world, leaving the risk for social unrest and pressure for social support programs high. State inefficiency, public-sector brain drain, the collapse of service delivery on municipality level, high crime statistics and a vulnerability to adverse weather conditions continue to pose a risk to South Africa’s long-term prospects.

Main data releases incorporated in the update

2024 data is now available. ReX has been updated with the latest data available from StatsSA, SARB QB, SARS and many more that allowed us to model and incorporate 2024 data on a sub-national level for most modules in ReX for the following modules:

- Demographic

- Development

- Income & Expenditure

- Economic

Infrastructure and Fiscal will be updated in quarter 2 of 2025 when General Household Survey and P9114 are released, respectively. Tourism is also dependent on the release of South African Tourism data which still requires the latest quarter 4 values from the Domestic Performance Report as well as the Domestic Tourism Survey for 2024.

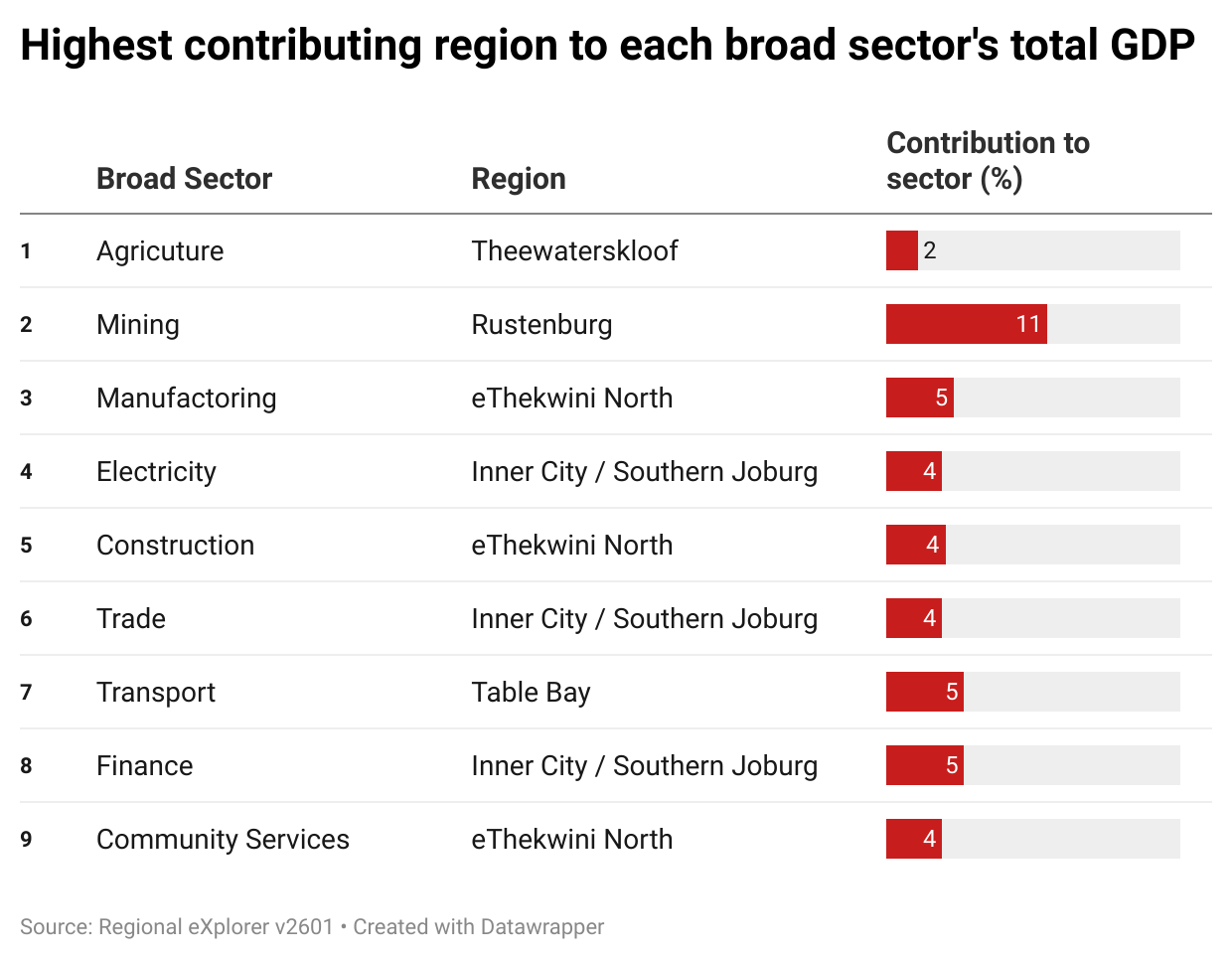

Based on the data for South African GDP in 2024, specific regions have emerged as the highest contributors to various broad sectors of the economy. Two sub metros of the 248 regions, that South Africa is composed of, stood out as the highest contributors to multiple sectors with Inner City/ Southern Joburg leading as highest contributing region for Electricity, Trade and Finances. Meanwhile, Rustenburg local muncipality is a dominant player in the mining sector, accounting for 11% of this sector’s national GDP total. This data illustrates the varied regional economic performance and highlights the critical sectors driving South Africa's GDP in 2024.

Enjoy the update!

The S&P Global ReX team